Charitable Donations For 2024

Charitable Donations For 2024 – Receipts. For gifts of $250 or more, donors must obtain from the charity a contemporaneous written acknowledgement of their contributions during the tax year. Where similar items are gifted throughout . While the presence of these scams shouldn’t deter you from giving, it’s important to verify charitable organizations before you make a donation, especially in times of crisis. “Knowing we’re .

Charitable Donations For 2024

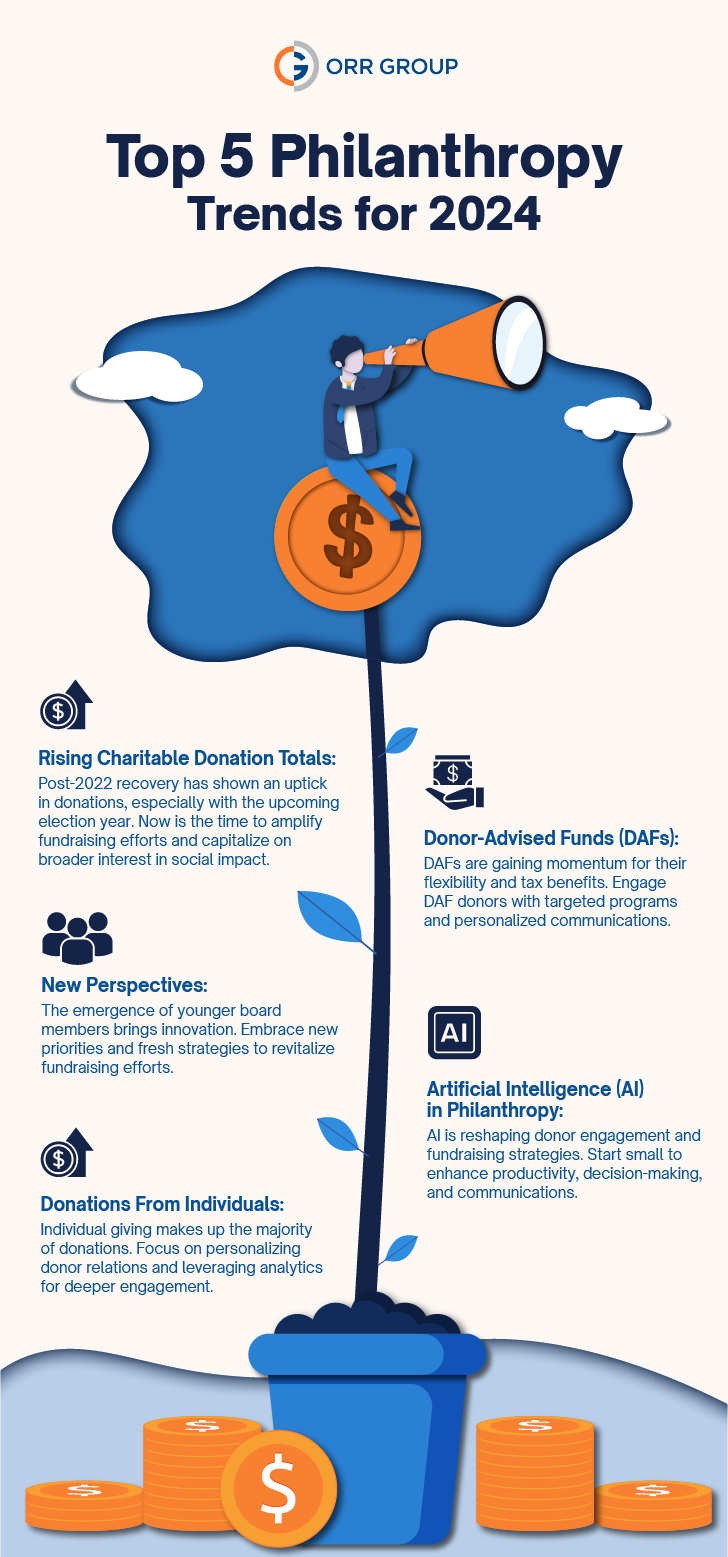

Source : www.cnbc.comPhilanthropy In 2024 And Beyond: Trends, Transitions, And

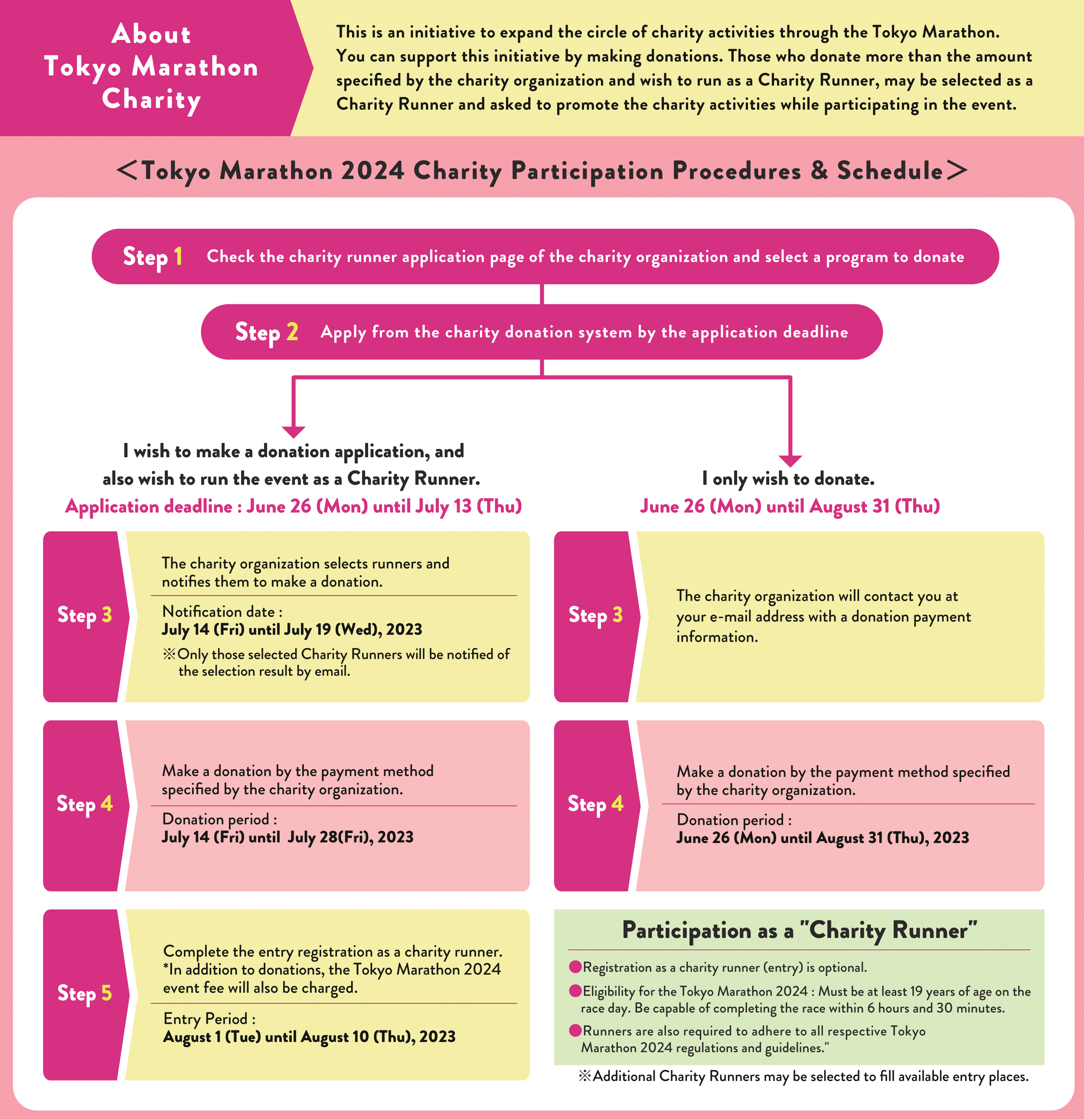

Source : orrgroup.comCharity | TOKYO MARATHON 2024

Source : www.marathon.tokyoTop 10 Charities to Donate to | Best Non Profits [2024]

Source : sapa-usa.orgThe Complete Charitable Deductions Tax Guide (2023 & 2024)

Source : www.daffy.orgTop 10 Charities to Donate to | Best Non Profits [2024]

Source : sapa-usa.orgHow to Receive Charitable Tax Deductions in 2024 | SmartAsset

Source : smartasset.com30 of the Best Charities to Donate to on GoFundMe (2024)

Source : www.gofundme.com3 tax moves to optimize your charitable donations for 2024

Source : www.mabetax.comCatholic Charities Appeal

Source : m.facebook.comCharitable Donations For 2024 Three tax moves to optimize your 2024 charitable donations: January 8 marked the day when Kars4Kids received a 1989 Chevy Beretta lowrider as a donation from Medhat Beshai, with the hope that it would find a loving new home. But contrary to his wishes, it wasn . I research/write about all facets of retirement/retirement planning. You might be able to deduct charitable contributions in 2023 even if you don’t itemize expenses on Schedule A. Charitable .

]]>